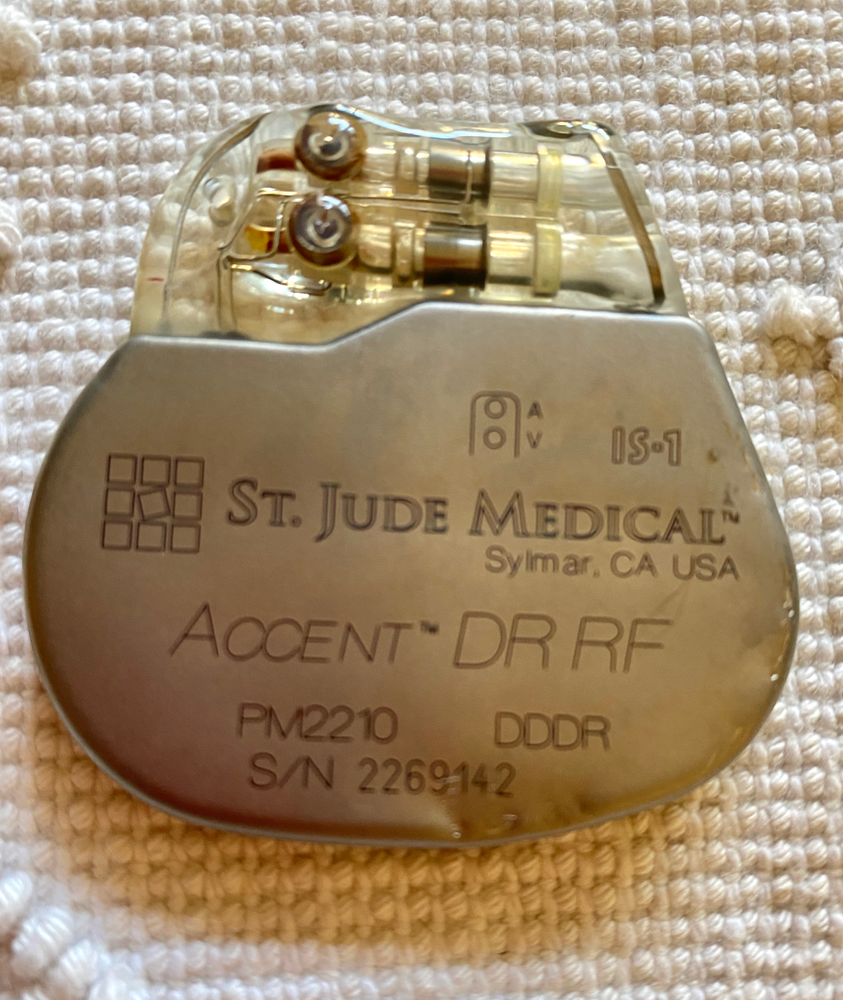

My 10-Year-Old Pacemaker Battery

During the last six months, we have limited our shopping, travel, and social engagements. We have pivoted our business’s and rearranged all our meeting and workflow to virtual platforms. We have all sacrificed our “normal” during this pandemic.

One thing we should not put on hold is our health. Doctors have advised keeping in contact with our doctors and maintaining our medical and dental health. There are ways to do doctors’ visits safely and like so much of the other elements of our lives they too can be done virtually.

Therefore, when my cardiologist called and said that my pacemaker’s battery had 1{3d6dbc71924036dc84d03e127ac76bdadbd8c8a98a857b840df2a314c6812e26} left, I immediately made an appointment to get it replaced. We cannot put things on the back burner. We need to take care of ourselves so that we can keep ourselves as fit as possibly so our health is not compromised.

In addition to taking care of yourself please remember to take care of your senior parents. They need to have their annual checkups and monitor their health issues. The CDC recommends talking to your doctors and having check-ins via online, email, by phone or virtually through telemedicine. If it is essential that you visit the doctor or dentist, follow the safety protocols provided by the CDC your doctor’s office. Please stay safe out there and wear a mask.

The Medicare Moment Is Now

Medicare’s Open Enrollment Period is from Oct. 15 to Dec. 7, 2020. This is the time to review your Medicare health insurance and prescription drug coverage for next year. I want to make sure that you understand the importance of open enrollment and that you have the resources to make the most-informed decisions.

By reviewing your coverage each year, you identify pitfalls that could derail your long-term financial plan and you identify potential savings. There are many insurance changes this year like the amounts you pay in premiums and deductible increases. Insurance carriers can also change their drug formularies, meaning a drug that costs you a few dollars each month could double or triple in price next year if dropped from your carrier’s formulary.

What is Medicare’s Open Enrollment Period?

Each year from Oct. 15 to Dec. 7 is when you can make changes to your Medicare Advantage or Medicare Part D Prescription Drug coverage for the coming year. If you are on a Medicare Supplement health insurance plan, you may want to review that plan as well, because those premiums also can change.

Why is reviewing my Medicare Part D Prescription Drug coverage each year so important?

If you have new medications, have switched medications or your insurance carrier changes its drug formulary, your costs could skyrocket if you do not carefully review your current plan. And switching to a plan because you can save on the monthly premium could be costly, too. The plans with the lowest premiums are not always the better financial choice. The cost of one month’s worth of one drug that is not on your plan’s formulary could exceed an entire year’s worth of your monthly premiums

You do not have to understand all the plans and details to conduct a thorough review. There are professionals out there that can review your current plan, tell you how it would change next year, compare it to other plans and help you find one that fits your specific needs and budget. You do not pay anything for this service, and you are not obligated to change or purchase anything.

I am a member of the Senior Estate Concierge Group (www.seniorestateconcierge.com) and here are two professionals I would recommend to call and help you navigate.

Brooks Boyd

Senior Savings Organization

713.927.8872

brooks@seniorsavingsorganization.com

https://www.seniorsavingsorganization.com

Steven King

King Insurance Agency

281.496.3800

https://www.kinginsuranceservices.com